We love a good McKinsey report here at Gloo. This one, a joint effort with the World Economic Forum, titled “Lighthouse manufacturers lead the way—can the rest of the world keep up?”, caught our eye. Clients often ask us to produce reports looking at how new technology is affecting specific industries, and manufacturing is one that keeps coming up. So, we were very interested to see what McKinsey thinks.

What’s the problem?

Manufacturers—from automotive and engineering to food, drink and consumer packaged goods (CPG)—are facing disruption. For many, one of the biggest challenges is responding to changing consumer demands. This is leading to shorter product lifecycles, which in turn is putting pressure on manufacturers to speed up innovation, development and productivity. Competition is fierce and new entrants are emerging to meet fragmented market demands. Manufacturers are also struggling to maintain visibility of their global supply chains, as they deal with increasingly complex networks of suppliers, assemblers and distributors. And all of this isn’t being helped by skills shortages across the sector—millennials and generation Z simply aren’t seeking jobs in factories.

“Manufacturing has experienced a decade of productivity stagnation and demand fragmentation; thus innovation is long overdue.”

We’ve written a lot about how the latest technologies can help manufacturers meet these challenges. Focusing just on the need to gain a competitive advantage, McKinsey suggests that technology is making it possible, but only for manufacturers that become “lighthouses”.

The case for being a technology innovator

McKinsey defines ‘lighthouses’ as organisations leading the way in “Fourth Industrial Revolution innovation”. It contends that just as a real lighthouse lights the path to guide ships through darkness, these companies are forging a path with the latest technologies, showing everyone else how to navigate the modern world and arrive safely in a state of stability, efficiency and profitability.

According to McKinsey, lighthouses are companies that meet high standards across four categories:

- Significant impact achieved through adopting the latest technology

- Successful integration of several use cases of this technology with existing systems

- A scalable technology platform—ready for the future

- Strong performances on critical enablers such as change management, capability building and collaboration

We can’t really argue with any of those. Really all it is saying is that to be a lighthouse, manufacturers need to be able to show that the technology they have chosen works for its intended purpose and is hitting targets, works well with existing systems and won’t need replacing as the business changes. No massive insight there.

One of the most interesting findings in the report is just how many innovation projects manufacturing lighthouses are working on. At first glance, 10-15 projects might sound like a lot, but these are massive companies with global footprints—examples include BMW, P&G and Siemens.

Lighthouse manufacturers have, on average, 10-15 use cases at an advanced stage and are working on the development of an additional 10-15.

We’ve written before about falling into the trap of focusing on examples from your neighbourhood. Some of the most interesting examples of the Internet of Things (IoT) we’ve seen come from Africa, an area massively underrepresented in the media. McKinsey found that being in an emerging or developing economy was no barrier to being a lighthouse.

“In fact, China is one of the leaders with a high number of lighthouses, and other lighthouses are located in Eastern Europe. This shows that other financial and operational benefits are more relevant than labor [sic] cost reduction.”

The benefits of being a “lighthouse”

McKinsey concludes that early adopters get a clear advantage over their competition. For example, it found that those adopting artificial intelligence (AI) early can anticipate a cumulative 122% cashflow change, while “followers” can only expect to see a 10% change.

“Thus, the largest factor here is related to the competitive advantage of front-runners, which by far outweighs the higher transition costs and capital expenditure related to the early adoption.”

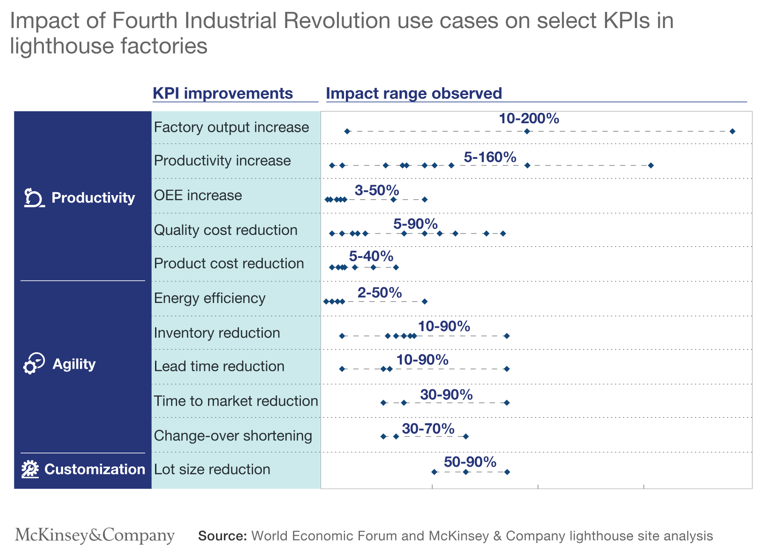

But there’s massive variation. For example, increase in factory output was between 10% and 200%. Without seeing the distribution of data it’s impossible to say for sure, and it’s hard to draw firm conclusions from such a large spread of data.

Conclusion

It might be semantic pedantry, but I feel that calling these manufacturers lighthouses endows them with a sense of purpose. It makes it sound like they’re choosing to set themselves as examples. A few probably are, but most are driven by simple self-interest—as they should be, they have shareholders to please after all.

Also, don’t lighthouses signal where not to go? They don’t show the way, they warn ships off the rocks. I don’t think that’s what McKinsey is trying to convey. While an interesting read, there’s not a lot new in this report. McKinsey is very good at creating succinct models, and there are plenty in here. But probably the most valuable insight in this report comes from the interviews with individual manufacturers. Of course, McKinsey isn’t going to give everything away in a report like this, but this wasn’t really enough to whet my appetite.

Key takeaways

1. Data-driven decision making is key to the future.

It’s not exactly news, but it’s worth reiterating. Leveraging vast quantities of data, including that gathered from IoT devices to fuel advanced analytics and AI can accelerate and improve decision making. It’s also making it possible to create “digital twins”—detailed virtual replicas of real-world systems, like factories or supply chains—that enable companies to identify dependencies and causation and model the impact of possible changes.

2. The results are in, agile won.

“The lighthouses implement new use cases in an agile working mode, which allows them to do proofs of concept in a short time, improve the solution based on learning, and go quickly from pilot to scale-up. This is a matter of weeks versus years.” An important component of this the devolution of technology decisions: “Technology on the shop floor is transforming ways of working, as operators develop their own apps and solutions to facilitate and automate their tasks.”

3. Being an incumbent is not the millstone it’s often painted as.

“Despite the misconception that legacy equipment and older facilities create a barrier to innovation, most of these lighthouses were in fact created by transforming existing brownfield operations.”

Posted by John on 9 May 2019